Hello,

Once every year….our bosses call us up…demanding to know what we have achieved in the past year…so to dictate how much performance bonus we get….

Then you start to see the balls carriers have already accumulated some political points….hahahah

………….

Yes, Mr CopyKat strikes again…the title’s stolen from another book’s title… 🙂

http://eservice.nlb.gov.sg/item_holding_s.aspx?bid=14159434

The current bullish run looks unending (yet)…I was waiting for it to end in Jan so I can make a quick review of the trades in 2012, ending with the last long trade established in Dec12…

Never mind, I will try to do a cut off on 31Dec12 then.

I follow closely to the turtles rules (wtf?….I know I know….) and the 5 guiding questions to formulate a disciplined approach (or a trading system) to trading.

1)Markets – What to buy or sell

2)Position Sizing – How much to buy or sell

3)Entries – When to buy or sell

4)Stops – When to get out of a losing position

5)Exits – When to get out of a winning position

Here a brief outline.

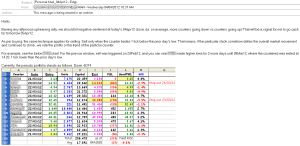

I trade short term trends. Prefering liquid counters that moves well with the market. I use a volatility based approach to limit losses, so in a way, it limits how much I can buy per counter. How much to risk per counter is based on historical backtested maximum drawdown. I also use market breadth to be my guide on market sentiment, or conditions, or trend, to decide and time when enter or exit the market.

Hey, I just answered all the 5 questions 🙂

Additionally, sometimes we often a a bit hand itchy, wanting to buy more…”buying the dips”…. I like alexander elder’s triple screen method….so I use it when the trend has been fully established and well on the way.

So that’s why you see the triple screen suggestions and musings in jan, way after the initial trend was established (for me….) in dec…

With all the above guidelines that I adhere to….I give myself slightly better odds in the equity markets…thus… trading like a casino…. 🙂

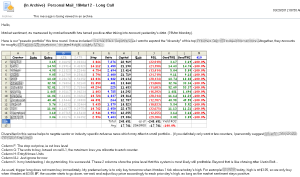

Green meant market breadth turned bullish and can look for entry, and red meant no long bullish (ie trading range or down), so can look to exit and stay cash.

Anyway, here goes… the 1st 6months, Jan to Jun 2012

1st Window; Early Jan 12 – Late Feb12

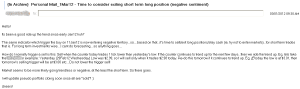

Market breadth was up in early Jan12, and went down in late Feb12. We concluded with a net gain of $15,616 from a pseudo $250k capital. Swee huh..

2nd Window; Mid Mar12 – Early Apr12

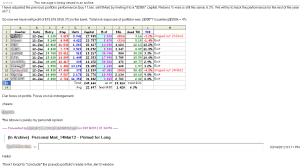

March trade was negative. Down $2,624 to $12,974 for 250k cap. Pui! But a losing trade does not mean a bad trade, a good training and reminder when to cut loss when market sentiment is bad…and stay in the side lines….

No need to tell you what happened to our markets from Apr 12 to Jun 12 huh? Dun remember? … “Sell in May and go ….” sheeesh…cheesy.

Ok continue tmr for jun to nov

cheers